Will this global

Covid-19 storm blow pension schemes onto a new course?

Our viewpoint

16 March 2020

It’s a well known mantra that a defined benefit pension scheme is a long-term obligation and so trustees and sponsors should set a long-term investment strategy and take a long-term approach to weathering macroeconomic storms and fluctuations in financial markets. In a business as usual scenario, this - of course - is eminently sensible.

COVID-19: the impact on Business disruption

However, as we know, business is very much not happening as usual. It may be that the pandemic is controlled and managed. But it is becoming increasingly clear that this will come at a cost, to businesses, the economy and to all of us.

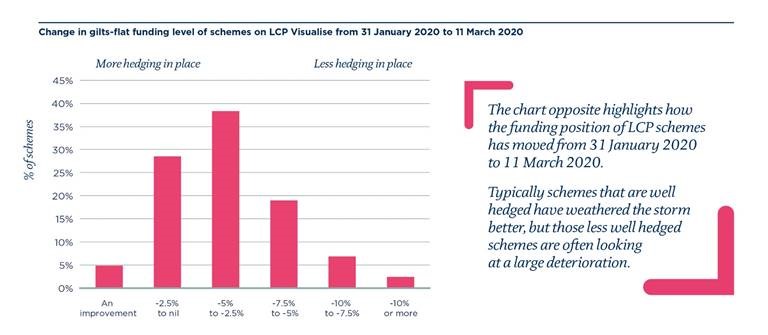

So far, the UK government has cut interest rates to 0.25% (and the US government has now cut interest rates to almost zero) and at 11 March 2020 the FTSE all world index had fallen by around 14% since the start of the year, and the situation continues to develop day by day. These events have already impacted many schemes through increased liabilities and falling asset values. However, the funding impact has very much varied from scheme to scheme largely driven by their hedging level as shown below.

As at 11 March 2020 the aggregated funding level of LCP pension schemes (on a gilts flat basis) has declined by 4% since 31 January 2020. Should this be typical across DB schemes this could translate to an industry wide fall of c£65bn (based on an aggregated asset base on the PPF index of c£1,615bn as at 31 March 2019).

This possible increase in deficit – which for some may be very significant as shown in the table above - comes at a time when cash may be constrained for many sponsors. However, sponsors are susceptible to a wide range of business and financial risks, and for this reason we consider it critical for trustees to pay appropriate attention to the other piece of the pensions puzzle – the impact of these events on sponsor covenants.

Understanding shocks to your sponsor covenant in uncertain times

A scheme’s covenant underwrites the short and long-term risks taken by a scheme. When a global shock like COVID-19 occurs, for lots of sponsors it will throw into question whether that covenant support over the long (or even short term) will remain available to the scheme, and whether the levels of investment risk that are being run (to get the scheme to its “end game”) can ultimately be supported.

There are significant risks being faced by a wide range of industries (eg travel, tourism, hospitality, finance, high street retail, insurance, education, manufacturing, the charitable sector and many others). In addition, we expect numerous industries who are reliant on the globalised economy to face an uncertain time (eg industries heavily integrated with the countries on lockdown.) The ongoing oil price war between Russia and OPEC is another factor which may be impacting certain sponsors.

This is not a time to be complacent as even the strongest sponsors are not immune to the current crisis. Special attention should be placed on sponsors who operate within clearly stressed industries, have high levels of debt (which may include stringent banking covenants) and which also have a high level of non-discretionary spend (eg interest payments, capital commitments).

Schemes with 31 March 2020 valuation dates may now have an entirely different outlook, especially if they are looking to their covenant to underwrite a larger level of risk (due to worsening funding levels), at a time when their sponsor may be under significant stress. We wait to see what the Regulator suggests for such schemes in the 2020 Annual Statement now expected after Easter.

All of this highlights the importance of having a robust and integrated covenant monitoring framework in place, proactive engagement with sponsors to ascertain the impact of these events and independent, joined-up advice. We set out some suggested actions to mitigate these emerging risks below. Please don’t hesitate to get in touch with a member of our covenant team to find out more information about how we can help.

Suggested actions for trustees

- Proactively engage with your sponsor to understand how their business may be impacted by COVID-19 in both the short and long term – is there any short time cash constraints or impact on growth projections for example.

- Proactively engage with your covenant advisor to understand whether changes have an impact on their covenant assessment and its ability to support the risks in the scheme. A materially larger funding gap may require further support from a distressed or cash constrained employer or considering whether the covenant can support the existing level of risk.

- Consider the impact on current projects - for example triennial valuations, PPF certifications, investment strategy reviews, liability management, de-risking activities. A change in covenant view may impact the overall strategy of the Scheme.

Note: The scheme data used for this blog is relevant as at 11 March 2020. We recognise that circumstances are constantly changing, and more material will be released to our clients over the coming days and weeks to reflect this.