COVID-19: Impact

on reserving – survey results

Our viewpoint

22 December 2020

We surveyed non-life insurers on how COVID-19 had affected their reserving.

We asked about the overall impact on loss ratios, the most heavily impacted classes, and how COVID-19 had affected the claims and reserving process. We also asked insurers about their plans for 2021, including expected changes in initial expected loss-picks.

Who participated in our survey?

The graphic below sets out the range of participants in terms of GWP, number of lines, and the type of insurance business written.

Impact of COVID-19 on loss ratios and management margins

Respondents reported a wide range of COVID-19 impacts on loss ratios. 70% of firms expected an increase in loss ratios. 1 in 5 respondents were expecting a 2020 loss ratio increase of more than 10%.

Despite the wide range of impacts on loss ratios, relatively few insurers were expecting to change their management margins at year end. 35% had increases planned. None were expecting to decrease them.

The classes with the highest expected loss ratios were: contingency & cancellation; health & unemployment; and property BI. However, it was interesting to note insurers predicting COVID-19 impacts on a wide range of other classes.

At the other end of the scale, Motor was the only class that stood out amongst respondents as having a loss ratio reduced by COVID-19.

Impact of COVID-19 on claims handling

Insurers reported a variety of changes, most notably to the speed of claim notification and settlement. Actuaries should be on the lookout for associated changes in development patterns at year end. About a third of respondents saw brief changes but a quick return to normal – although note that our survey pre-dated the 2nd lockdown.

No respondents reported changes to their case estimation philosophy. Although this may be valid, we think it will be hard for claims teams to ensure that, in practice, case reserving strength remains consistent despite COVID-19 disruptions. It will be important for actuaries to engage closely with the Claims function to understand changes, rather than merely seeking positive affirmation that the case reserving philosophy is unchanged.

Impact of COVID-19 on reserving

Nearly 60% of respondents anticipated increased management interest in reserving at year end. We were actually surprised this proportion wasn’t higher, given the changes in loss ratios that many insurers were predicting and the fact that almost 3/4 were expecting to see at least some change to development patterns.

With changes in claims handling, development patterns, and increased management interest in reserving, it’s no surprise that around 95% of reserving teams are planning on doing additional analysis as a result of COVID-19. The most common additional work was enhanced sensitivity and scenario testing, followed by deep-dives on key classes and enhancing reserving validation. Surprisingly few insurers were seeking out supplementary data or using more granular reserving classes.

Beyond direct COVID-19 impacts, what other challenges lie ahead in 2021?

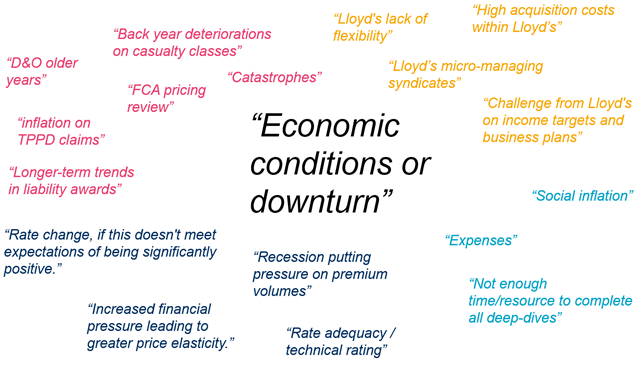

Finally, we asked insurers about their key profitability concerns in 2021. A central theme was the consequences of a prolonged economic downturn that may follow COVID-19. Beyond this, several insurers raised concerns about their ability to achieve the rate increases they felt might be necessary, whilst others had concerns about specific lines of business, such as D&O and Casualty. Additionally, several Lloyd’s managing agents expressed concerns about the regulatory constraints of operating in the market.

Conclusions

It’s clear that COVID-19 will have an effect on many insurers’ loss ratios as we approach year-end. Developments on COVID-19 can be particularly fast paced, so it will be important to set dynamic scenarios that can be quickly updated if the outlook changes, particularly in the “danger window” between finalising the actuarial estimate and the final year-end finance booking.

Looking ahead to 2021, firms will have to grapple with the outlook from COVID-19 and a distorting impact on claims development that may persist for several years. Simultaneously insurers will be addressing the impact of Brexit, significant regulatory developments like the FCA Home and Motor pricing review, and increased levels of scrutiny at Lloyd’s. No matter which way you look at it, insurers will certainly have a lot on their plate in next 12 months!