Addressing the

PRA’s “Dear CRO” letter

Our viewpoint

6 January 2021

Our special roundtable generated plenty of thought-provoking discussion on the recent “Dear Chief Risk Officer” letter issued by the Prudential Regulatory Authority.

It was great to see so much interest in this ahead of the year-end reserving exercise, which is likely to be particularly challenging given the complexity and uncertainty that COVID-19 brings.

Key areas of discussion included:

- The responsibility of the CRO in the reserving process – the general consensus was that, while the CRO is not responsible for setting the reserves (or ensuring they are correct), they should ask questions, offer an alternative perspective and provide robust challenge through being an active member of the reserving committee. In addition, it was thought that the CRO should be responsible for identifying significant weaknesses in the reserving process and for ensuring the board is aware of the key uncertainties in the proposed reserves.

- Plans to challenge and validate COVID-19 assumptions – a range of techniques are being used to come up with a best estimate and understand the uncertainty, including stress and scenario testing and reviewing (re)insurance policy wordings. There was also discussion around the societal expectation that insurers should pay (regardless of the niceties of policy wording) This needs to be considered when setting and challenging assumptions (not just for COVID). In addition, it was noted that actuaries played a valuable role in helping boards to understand the uncertainty following the 9/11 terror attacks and that they are best placed to take the lead again now.

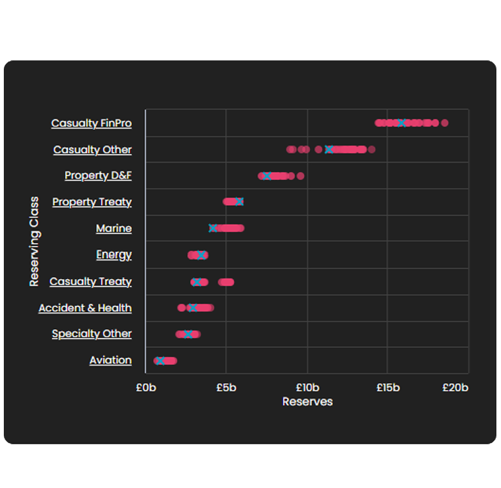

- Exposure management for non-natural catastrophes – many recognised this as an area in which their firm does not currently excel, particularly for emerging risks and casualty lines. There did not appear to be a lack of desire to improve. However, limitations such as poor availability of data and risks not being included within exposure management frameworks are preventing firms from progressing this further. In addition, some noted that the ability to measure and report on accumulations of risk across casualty lines was a particular challenge.

Addressing the current limitations in exposure management is a complex issue and may take time to fully resolve but firms should not shy away from the challenge. They should aim to establish a robust framework that allows reporting against their risk appetite. Wider thinking is required to identify the interdependencies and accumulations of risk across the portfolio as well as taking into consideration the potential for policies to respond differently to the way in which they were originally intended, as we are seeing with COVID-19.

It strikes me that the reserving points raised in the “Dear CRO” letter can be addressed more easily, provided the CRO and the board have sufficient information to enable them to provide effective challenge.

Here are a few ideas of things that can help to ensure appropriate information is provided:

- Reserving and risk teams should work together to define key metrics to include in management information packs (I have thoughts on the metrics that would be useful but I’ll save that for another day).

- Information should be provided in dynamic dashboards where possible with the ability to drill down or view using alternative segmentation.

- Key trends should be identified and highlighted to the CRO (and to the board).

- The reserving team should provide clear identification of key judgements.

- Quantification of the uncertainty in the reserves should be discussed in detail with the reserving committee (including the CRO) and discussed again with the board.

Although there was perhaps an element of self-selection in roundtable attendees, it was interesting to hear a possible shift in perception from those receiving such letters, with a number of CROs noting that the letter was not unwelcome, and was in fact a useful tool to check on their own processes and to improve risk management across the market.

We’d love to hear your views on the letter and how your firm is addressing the issues raised. If you would like to discuss or are interested in attending a future roundtable, please get in touch.