High gas prices mean

Prime Minister’s 40GW offshore wind bet is already paying off

Our viewpoint

9 September 2021

It’s been hard to ignore the recent jump in natural gas prices. With the world emerging from Covid-19, demand for natural gas, as well as other commodities, has rebounded.

High natural gas prices impact the whole economy, and the power sector is especially sensitive to price fluctuations in the gas market. This is because high gas prices affect the cost of generating power from gas power stations, and gas generation is often the marginal source of generation, and so in a market-determined by marginal pricing, these increased costs feed through to wholesale power prices.

We’ve seen day-ahead market power prices in GB averaging over £100/MWh over August, driven by high gas prices as well as carbon prices which have also reached record highs. This is surprising as August historically has some of the lowest prices over the year, due to lower demand and high renewable output during the day from solar power. These high prices are already having an impact on consumers’ bills, with Ofgem recently announcing that it will raise the price cap by around £150 per household from October this year.

High gas prices mean consumers could save up to £3.3bn from the UK’s increased 2030 offshore wind ambition

However, one of the benefits of renewable power is that the cost of generation is not impacted by changing gas prices, meaning consumers are protected from high gas prices during periods where renewables are the marginal source of generation. LCP’s latest research has found that the UK’s commitment to net zero could have larger financial benefits than previously expected.

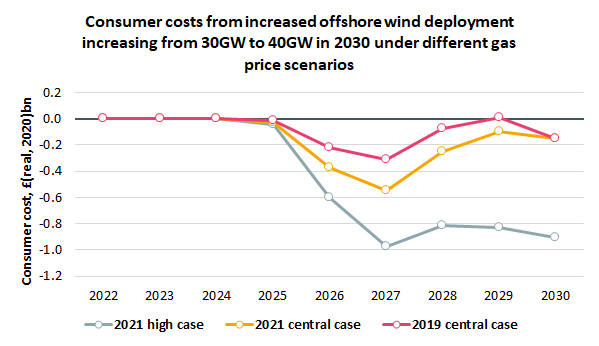

Based on the gas prices when the Government originally committed to a 40GW offshore wind target by 2030, our modelling shows a relatively small reduction in consumer costs compared to a scenario where only 30GW of offshore wind was built. But this earlier analysis assumed a lower gas price than what we’re seeing today. Assessing the consumer cost impacts of moving to a 40GW offshore wind target assuming today’s gas price persists, or even assuming revision back to a central price trajectory out to 2030, we see a much larger reduction in consumer costs.

To calculate the change in consumer costs, we modelled the impact that moving from 30GW to 40GW of offshore wind in 2030 would have on the GB power system. One of the main impacts of adding additional offshore wind is the resulting change in wholesale power prices. When an offshore wind generates power, it does this at close to zero marginal cost, meaning that when it is generating, it lowers the wholesale price. In periods where there is enough of this zero marginal cost generation to satisfy all of the demand, the wholesale price falls to close to zero or even negative (for example, in 2020 we saw zero or negative wholesale prices in around 100 hours). We then compared the reduction in wholesale costs to the additional Contracts for Difference (CfD) support that consumers would have to pay for the additional 10GW of offshore wind, as well as the additional support that would also be paid to all the other CfD supported generators as a result of the lower wholesale prices.

Expected consumer benefit from going to 30 to 40GW offshore wind has doubled from £0.6bn to £1.2bn

We looked at the change in consumer costs for 2022-30 that result from moving to a 40GW offshore wind target under three different gas price projections. The results showed:

- 2019 central case - £0.6bn reduction in consumer costs using an initial gas price of 45p/therm rising slowly over the decade to 55-60p/therm in 2030;

- 2021 central case - £1.2bn reduction in consumer costs assuming the current high prices track back to a central case of 55-60p/therm in 2030; and

- 2021 high case - £3.3bn reduction in consumer costs if gas prices remain at around 90p/therm out to 2030.

Source: LCP Energy analysis August 2021

Under all these gas price scenarios, the bet on going big with offshore winds looks to have paid off for consumers, and if high gas prices persist the savings for consumers will only be higher. And the benefits of increasing the offshore wind commitment go further than just cost savings. We also forecast that 11.8mtCO2e will be removed from the power system up to 2030 alone, which has a large impact on our carbon reduction commitments.

The benefits of having renewables on the system are now materialising, with new offshore wind projects able to deploy at levels that provide a real consumer benefit. High gas prices only act to increase the benefits of renewables and accelerate our transition to net zero – future generations will be less exposed to volatile international commodity markets. That’s without looking at the wider economic and industrial benefits that the renewables sector brings to the UK and the technology cost reductions enabling offshore wind to be pursued globally. The future is not only looking greener with more renewable generation, but also cheaper than originally expected.