Government takes

the sting out of pensions tax but some changes could be short lived

Our viewpoint

16 March 2023

News Alert 2023/02

At a glance

On 15 March 2023 the Chancellor announced the most dramatic changes to pensions tax in almost 10 years. These take effect from 6 April 2023 and include the abolition of the Lifetime Allowance (LTA) charge and the raising of the general Annual Allowance (AA) to £60,000 (and tweaks so that most people will have an AA of at least £10,000). Whilst some adjustments to the regime had been trailed in advance, the sheer scale of the changes was completely unexpected.

The proposed measures are intended to encourage back into work the huge number of workers aged over 50 who left the labour market during the COVID-19 pandemic – and address concerns that NHS clinicians are leaving because of unpredictable pensions tax charges. Whilst the success of the changes against that target will be judged in due course, in practice the changes also open the door to many people being able to make a lot more pensions saving than is currently the case. Equally, the easing of the regime may bring some scheme exercises into play which are currently not practical – for example in relation to GMP equalisation by conversion.

Operational details for 2023/24 are becoming relatively clear from HMRC’s pension schemes newsletter published on 16 March 2023.

At the same time, and perhaps equally importantly, the Chancellor also announced a freeze of the maximum level of tax-free cash and a plan to write the LTA out of legislation altogether from tax year 2024/25. However, the Labour Party has proposed to reverse the changes relating to the LTA and replace them with a “targeted scheme” for doctors. With an election looming this creates material uncertainty for savers.

Some actions to consider urgently

For those just about to retire who would have faced an LTA charge, there may be a clear advantage to delaying retirement until just after the charge is removed, if that is possible. Clearly schemes cannot give tax advice but trustees/employers might want to check with their administrators to see what individual cases, if any, are in progress and consider providing comparative quotations.

There may also be employees who might want to make pension savings before the end of the current tax year. For example, someone who stopped contributing because they took out Fixed Protection from the LTA Charge, might want to restart contributing and make use of both their 2022/23 AA and also any carry forward from 2019/20 before it is lost. However, doing so before 6 April could lose their enhanced scope for tax-free cash. Making contributions before 6 April might be an easier decision for those without a vulnerable protection. Given how close it is to the end of the tax year this is likely to be a matter for an individual to deal with by personal contribution.

Employers with DC arrangements will need to consider whether to adjust their offerings for cash in lieu of some or all of an employer’s DC contributions for 2023/24. For example, a standard offer for capping the DC contribution part at £4,000 pa might have the cap raised to £10,000; and the earnings entry point for access to the option might be raised. Whether those with an LTA protection should, from 6 April 2023, no longer be granted cash in lieu of all DC is a harder decision given the Labour Party’s stated intentions.

Given the different impact on different savers, it may be important to get a description of the change in regime out to members as soon as possible; and also to identify any existing material that needs early change (or at least to be stamped with a warning) so as not to mislead.

A range of pensions projects may be eased by the changes. We consider some of these in the body of this document.

The Detail

The Lifetime Allowance

On 15 March 2023, in a key part of the Budget, Chancellor Jeremy Hunt announced that the LTA would be abolished. This went a lot further than the pre-Budget speculation which had coalesced around a significant increase, anticipated to be £1.8m.

Effectively, this means that from 6 April 2023, any benefits “crystallised” in excess of the LTA (which remains at £1.073m or higher where protections apply) will be subject to income tax at the recipient’s marginal rate(s), rather than (broadly) 25% extra on top of income tax if excess benefits are taken as pension (including designation into drawdown), or 55% if taken as lump sum (including death and serious ill health lump sums).

The LTA itself will not immediately disappear; rather it is the LTA Charge that will be removed with effect from 6 April 2023. The intention is that the abolition of the LTA will take place during the 2024/25 tax year. There is clearly a great deal of thinking still to do in terms of how that will work given that so many of the tax regime features centre around this item.

HMRC has confirmed that, in the meantime, the LTA framework remains in force. Importantly, pension schemes will need to continue to operate LTA checks etc in the same way that they do presently.

Whilst the LTA has effectively been removed, the maximum level of tax-free cash (PCLS) has not been increased commensurately with the level of possible pension savings: the maximum pension commencement lump sum (tax-free cash) will be frozen, for those without protections, at £268,275 (i.e. 25% of the current standard LTA).

The intention seems to be to hardcode this limit so that over time the scope for drawing tax-free cash will reduce in real terms. Details are not yet available of how past and on-going drawings of benefit or PCLS will use up this maximum.

Current protections (such as Fixed Protection, Individual Protection and scheme specific lump sum protections) will be relevant for a higher fixed cap on tax free cash than £268,275. HMRC has confirmed that after 6 April 2023:

- Anyone who had applied for a protection by 15 March 2023 and retained a valid protection as at 6 April 2023 will retain their entitlement to a higher PCLS

- They will also be able to accrue new pension benefits, join new arrangements or transfer without losing their protections

This suddenly frees up (particularly from 6 April 2023) options for individuals who had ceased making pension savings, either because they were at or around the LTA, or because they had elected for one of the protections that meant they were not able to accrue further benefits. Even if extra savings might not attract more scope for tax-free cash sum, there are still valuable tax incentives to be gained, as things stand.

Some further comments in relation to the LTA

In the opening section of this Alert we described some immediate actions that schemes, employers and members may need to take in relation to the LTA. Some further considerations are set out below.

Many scheme exercises could be back on the table or simplified because of the removal of the blocks previously caused by the need to maintain protections, and indeed not to create LTA charges themselves. These include Pension Increase Exchange exercises (particularly after retirement) and Bridging pension options – highly popular with members but very inefficient from an LTA perspective.

Similarly, not having to worry about LTA protections could simplify GMP equalisation by conversion and enable buy-out projects to complete which have stalled due to concerns around Fixed Protection implications for pensioners.

Unless changes are made to the law, exemptions from auto-enrolment and re-enrolment obligations due to a member holding a protection will continue.

At present, many organisations use an “excepted life” policy to provide life cover, particularly for individuals where the LTA is a potential issue. These arrangements will still have a role for 2023/24 at a minimum, but their operation may need to be checked.

A greater Annual Allowance

The Chancellor also announced a 50% increase in the general Annual Allowance from 6 April 2023, from £40,000 to £60,000 – this will give most earners the scope to make much larger pension savings without extra tax charges.

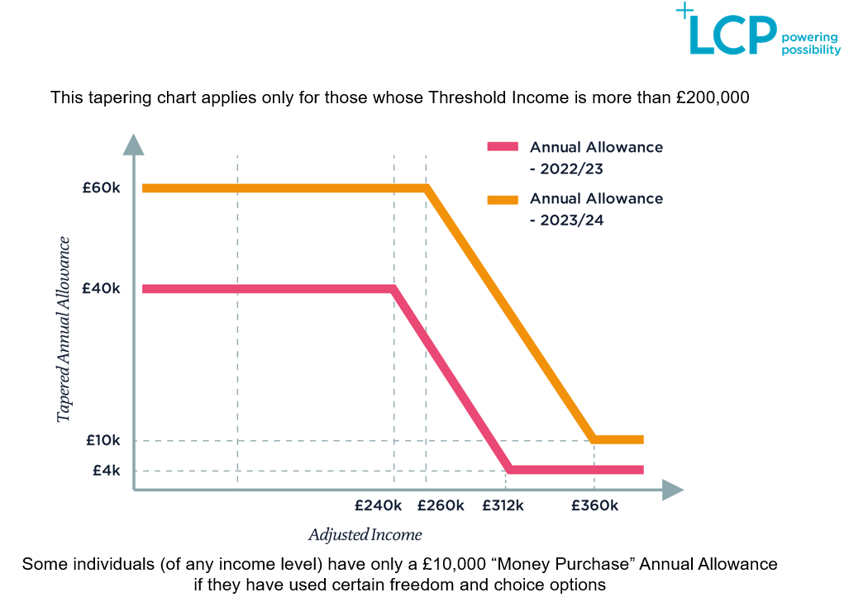

The highest earners (those with taxable incomes over £200,000) will still be subject to the “taper” measure and hence potentially a much lower personal Annual Allowance. The lowest level of the tapered AA will be £10,000 (compared to 2022/23’s lowest level of £4,000) and this will apply for those with “incomes” (inclusive of employer sponsored pension savings) over £360,000. This means only the highest earners have limited (but increased) scope to make tax efficient pension savings. Those with “incomes” between £240,000 and £360,000 will see an increase in their tapered Annual Allowance of between £6,000 and £30,000. The chart below shows the expected change.

No change has been mentioned to other features of the AA, so we assume that carry forward of unused AA from the past will reflect the AAs that applied for the member then. With the LTA Charge no longer being a deterrent to savings for 2023/24, but a risk of it being reintroduced following the next general election there will be some important planning issues for, in particular, DC savers.

Similarly, we assume that for DB schemes the concept of a “deferred member carve out” from the AA will still apply. Practical issues such as the trigger for having to send a proactive statement and offer access to Scheme Pays will presumably reflect the new general AA level.

Some further comments in relation to the AA

In the opening section of this Alert we described some immediate actions that schemes, employers and members may need to take in relation to the AA – particularly with the scope for DC savings opening up and the fact that (taking into account the changes in the Money Purchase Annual Allowance described below too) all individuals will now be able to put in £10,000 pa without fear of attracting an AA charge.

For the few still-open private sector DB schemes, the changes mean that members with high accrual in a tax year because of high pensionable salary or because of promotions will see lower or no AA charges.

Projects and scheme designs that were impacted by worries about potential AA issues may now have more leeway. For example, Pension Increase Exchange (PIE) options or bridging pension options at retirement, or GMP equalisation by conversion for non-pensioners.

A higher Money Purchase Annual Allowance

Currently, the £40,000 pa Annual allowance drops down to £4,000 pa in a number of situations where the individual accesses money purchase benefits from their mid-fifties. This can be a barrier to future pension savings where, for example, such an individual has gone part-time or has sought to retire, but subsequently wishes, or is required to recommence pension savings, perhaps because of a new job.

The purpose of what would seem to be penal treatment is to guard against older workers getting a tax turn, courtesy of the tax-free lump sum, by first contributing to a scheme and then accessing the benefits under the much more liberal provisions that have operated since the 2014 Freedom and Choice reforms.

The Chancellor has now taken action so that from 2023/24 onwards the Money Purchase Annual Allowance is set at £10,000. This should enable more older people returning to work to recommence pension savings. It will also help those who accessed some of their retirement pots, perhaps to assist with a family emergency or separation, without realising the consequences for future pension savings. And it better accommodates higher default required contribution levels that might arise from the proposal to reduce the lower limit to Auto Enrolment qualifying earnings.

LCP View overall

For many years, we have watched as both the Annual Allowance and Lifetime Allowance have been reduced time after time, with the scope for pension savings being “salami sliced” at successive Budgets, each time adding additional complexity and layer upon layer of transitional arrangements. The industry has long said that there is no need for both an input test (the AA) and an output test (the LTA) on pension savings; either one test would be sufficient. It is welcome that the Chancellor has listened. That said, the proof will be in the detailed documents to follow. Whilst the position for 2023/24 seems relatively clear, that is undoubtedly an interim step. The discussions to come in relation to 2024/25 and beyond will be key to establishing whether this really will simplify the position for schemes and individuals and reduce the huge amount of time and effort that is currently spent working through the complexities of the present regime.

The Labour Party has made clear that it will vote against these pension reforms and proposes to reverse the changes in relation to the LTA should it win the next general election, which also puts a question mark over the longevity of that aspect of this new regime.